News

Recent

137 press & news

Apr 02, 2024

The Mount Nittany Health Foundation is pleased to celebrate Jack and Karen Infield for their generous support for the Mount Nittany Health Children’s Advocacy Center of Centre County (CAC).

Mar 28, 2024

Kristina Sanders, CNA, Progressive Care Unit, is a much valued part of the Mount Nittany Health family. Her colleagues describe her as a very hard worker and a true asset to the patients she serves.

Mar 14, 2024

Mount Nittany Health is a proud corporate sponsor of the Team Ream Foundation. On Sunday, March 10th, Penn State hosted its annual Team Ream basketball game where Team Ream presented the Mount Nittany Health Foundation with a check for $25,000 to assist financially disadvantaged individuals in the Centre region who have been affected by cancer and other serious medical conditions.

Mar 12, 2024

Mount Nittany Health’s team of navigators helps patients deal with challenges they may experience with a cancer diagnosis. The navigators help remove barriers to care and serve as advocates for patients and their families.

Feb 27, 2024

Mount Nittany Health is pleased to announce that the Mount Nittany Health Foundation’s 75th Annual Charity Ball raised $507,750 to support the new Patient Tower at Mount Nittany Medical Center.

Feb 08, 2024

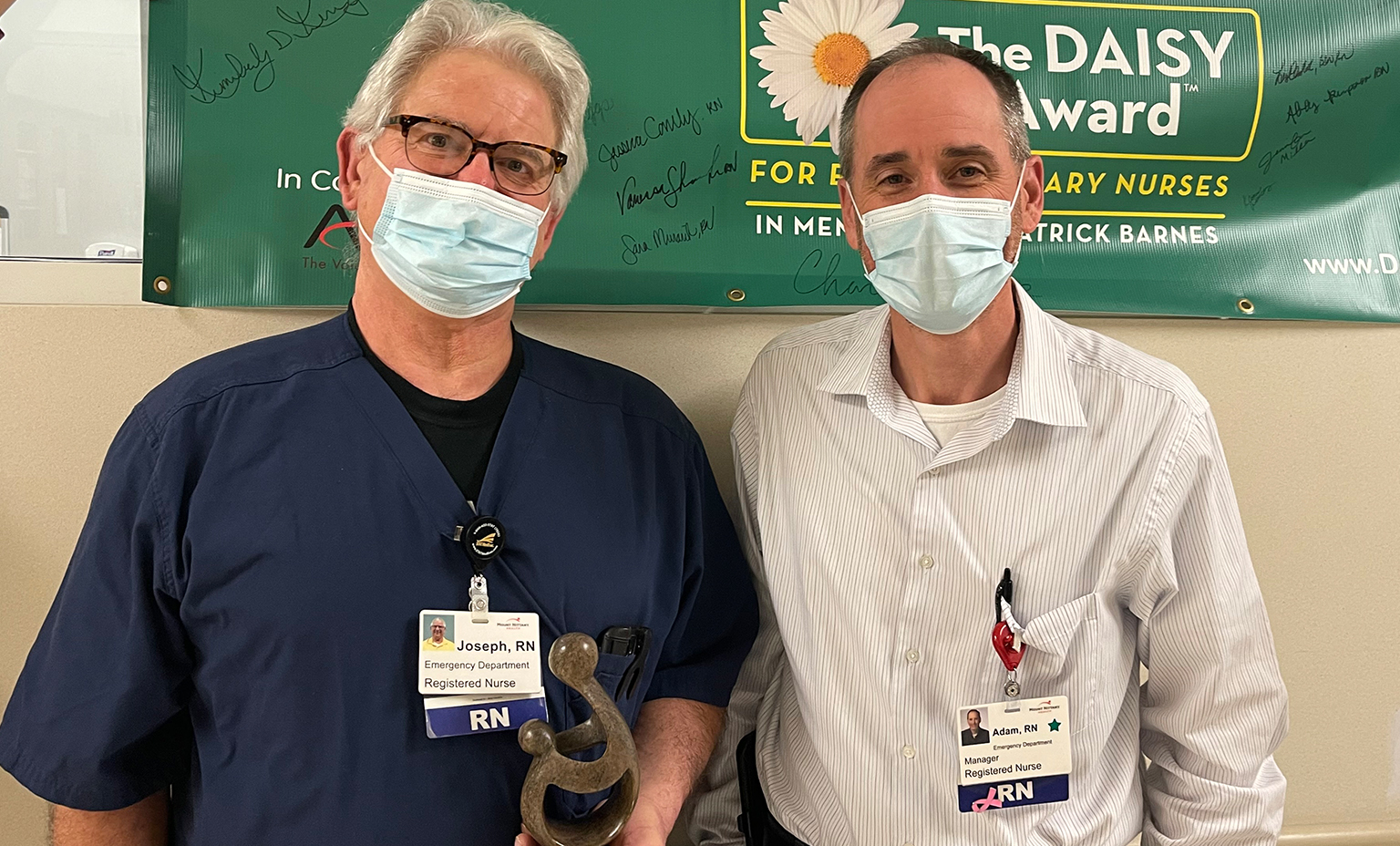

Joe Yindra, RN, is a wonderful asset to Mount Nittany Medical Center’s Emergency Department. He continually goes above and beyond for his patients, providing five-star quality care, and he is routinely recognized by his colleagues for being an exceptional clinician.

Jan 10, 2024

The Mount Nittany Health Foundation will host its Annual Charity Ball on Saturday, February 10, 2024, at the Penn Stater Hotel and Conference Center.

Make a difference.

Our donors' generosity enables the growth of expertise, advances in lifesaving technology, program improvements, and facility upgrades that meet the unique needs of the communities we serve.